Nivottam

Mutual Fund Investments in India

At Nivottam, we understand that building wealth requires strategic decisions, and mutual funds offer a diversified, professionally managed approach to investing. Our mutual fund services are designed to help you navigate the complex world of investments with ease and confidence.

Why Choose Mutual Funds?

Mutual funds allow you to invest in a broad portfolio of stocks, bonds, and other securities, spreading the risk and maximizing potential returns. Whether you’re a first-time investor or looking to diversify your portfolio, mutual funds are an ideal way to grow your wealth while reducing risk.

Benefits of Partnering with Nivottam

Diversification

Access a balanced portfolio without the need to pick individual stocks.

Expert Management

Our experienced fund managers handle investment decisions, so you don’t have to.

Liquidity

Enjoy easy access to your investments, with the flexibility to withdraw funds as needed.

Tax Efficiency

We guide you on choosing tax-efficient funds that optimize your returns.

We provide solutions to grow business

Mutual Fund

Portfolio Management Service

Unlisted Stocks

AIF

Corporate Fixed Deposit

MLD

We provide the solutions to grow busines.

With over 20 years of experience in wealth management and portfolio management services (PMS), our company is dedicated to helping individuals and businesses navigate the complexities of financial growth. Our expertise spans across a wide range of asset classes, providing tailored solutions that align with your financial goals and risk appetite.

Market Research

Dedicated Relation Manager

Supportive Team

Leadership Engagement

Why Choose Us

01.

02.

03.

04.

Why Choose Us

01.

50+

02.

20+

03.

10K

04.

100+

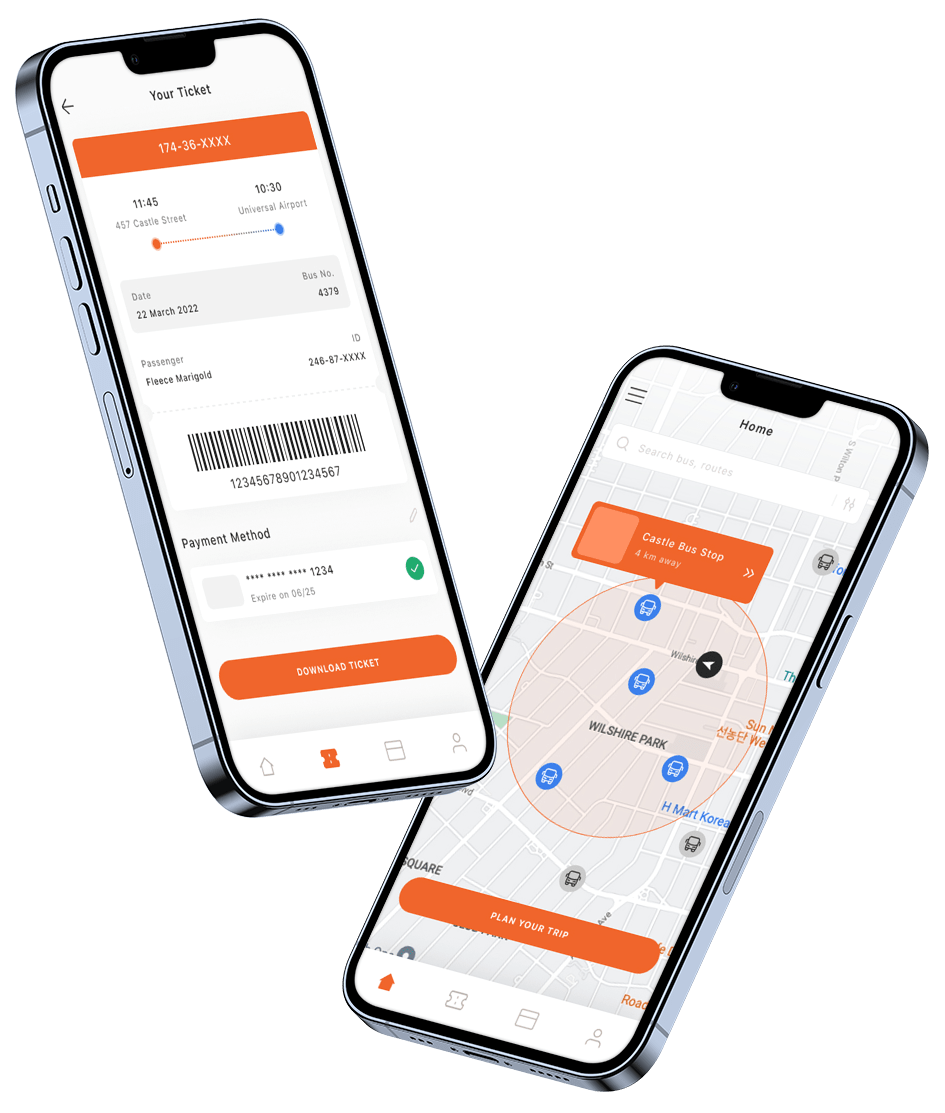

Download Our Application

Experience seamless wealth management at your fingertips! With our app, you can manage your investments, track your portfolio, and stay updated on market trends—all in one place.