Unlock Exclusive Opportunities

Unlisted Stocks Investment with Nivottam

At Nivottam, we provide access to a unique and often overlooked segment of the investment market—unlisted stocks. With our wealth of experience, we help you explore and invest in privately-held companies, unlocking opportunities that are not available on public exchanges.

What are Unlisted Stocks?

Unlisted stocks refer to shares of companies that are not yet listed on public stock exchanges like the NSE or BSE. These companies can be early-stage startups or well-established businesses preparing for IPOs. Investing in unlisted stocks allows you to get in early on promising ventures and potentially benefit from higher returns as these companies grow.

Why Invest in Unlisted Stocks with Nivottam?

Exclusive Opportunities

Nivottam’s network provides privileged access to high-potential companies that are not available on the public markets.

Pre-IPO

Investment

Many investors seek unlisted stocks to capitalize on a company’s growth before it goes public, aiming for significant gains once it lists.

Diversification

Unlisted stocks offer a unique diversification opportunity, allowing you to spread your investments across different sectors and stages of growth.

Long-Term Growth

These stocks often come with the potential for significant returns, especially when investing in companies with strong business models and growth trajectories.

We provide solutions to grow business

Mutual Fund

Portfolio Management Service

Unlisted Stocks

AIF

Corporate Fixed Deposit

MLD

We provide the solutions to grow busines.

With over 20 years of experience in wealth management and portfolio management services (PMS), our company is dedicated to helping individuals and businesses navigate the complexities of financial growth. Our expertise spans across a wide range of asset classes, providing tailored solutions that align with your financial goals and risk appetite.

Market Research

Dedicated Account Manager

Supportive Team

Leadership Engagement

Why Choose Us

01.

02.

03.

04.

Why Choose Us

01.

50+

02.

20+

03.

10K

04.

100+

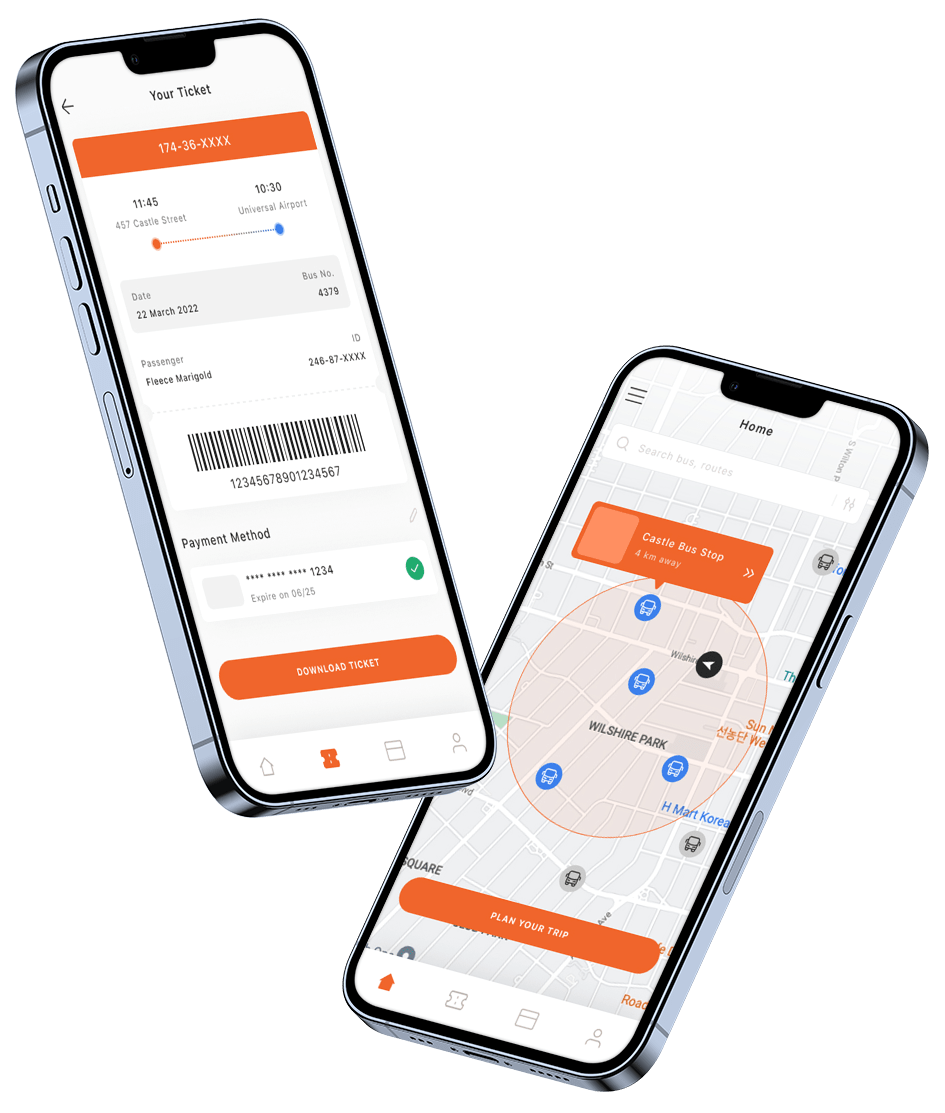

Download Our Application

Experience seamless wealth management at your fingertips! With our app, you can manage your investments, track your portfolio, and stay updated on market trends—all in one place.