Nivottam

Personalized Wealth Management Solutions

At Nivottam, we offer Portfolio Management Services (PMS) designed to meet the unique financial needs of high-net-worth individuals and discerning investors. With over two decades of expertise in wealth management, Nivottam provides personalized investment strategies to help you achieve your financial goals.

What is PMS?

Portfolio Management Services (PMS) is a professional service where we manage your investments on your behalf. This service is ideal for those looking for customized portfolio management, which goes beyond mutual funds or other standardized investment products.

Key Features of Nivottam PMS

Customized Portfolios

Every portfolio is constructed based on your specific needs, whether it's wealth creation, capital preservation, or generating a steady income.

Active Management

We continuously monitor and adjust your portfolio to capitalize on market opportunities and minimize risks.

Tax-Efficient Strategies

Our experts ensure your portfolio is optimized for tax efficiency, maximizing your after-tax returns.

Diverse Asset Allocation

We invest across a wide range of asset classes, including equity, debt, and alternative investments.

We provide solutions to grow business

Mutual Fund

Portfolio Management Service

Unlisted Stocks

AIF

Corporate Fixed Deposit

MLD

We provide the solutions to grow busines.

With over 20 years of experience in wealth management and portfolio management services (PMS), our company is dedicated to helping individuals and businesses navigate the complexities of financial growth. Our expertise spans across a wide range of asset classes, providing tailored solutions that align with your financial goals and risk appetite.

Market Research

Dedicated Account Manager

Supportive Team

Leadership Engagement

Why Choose Us

01.

02.

03.

04.

Why Choose Us

01.

50+

02.

20+

03.

10K

04.

100+

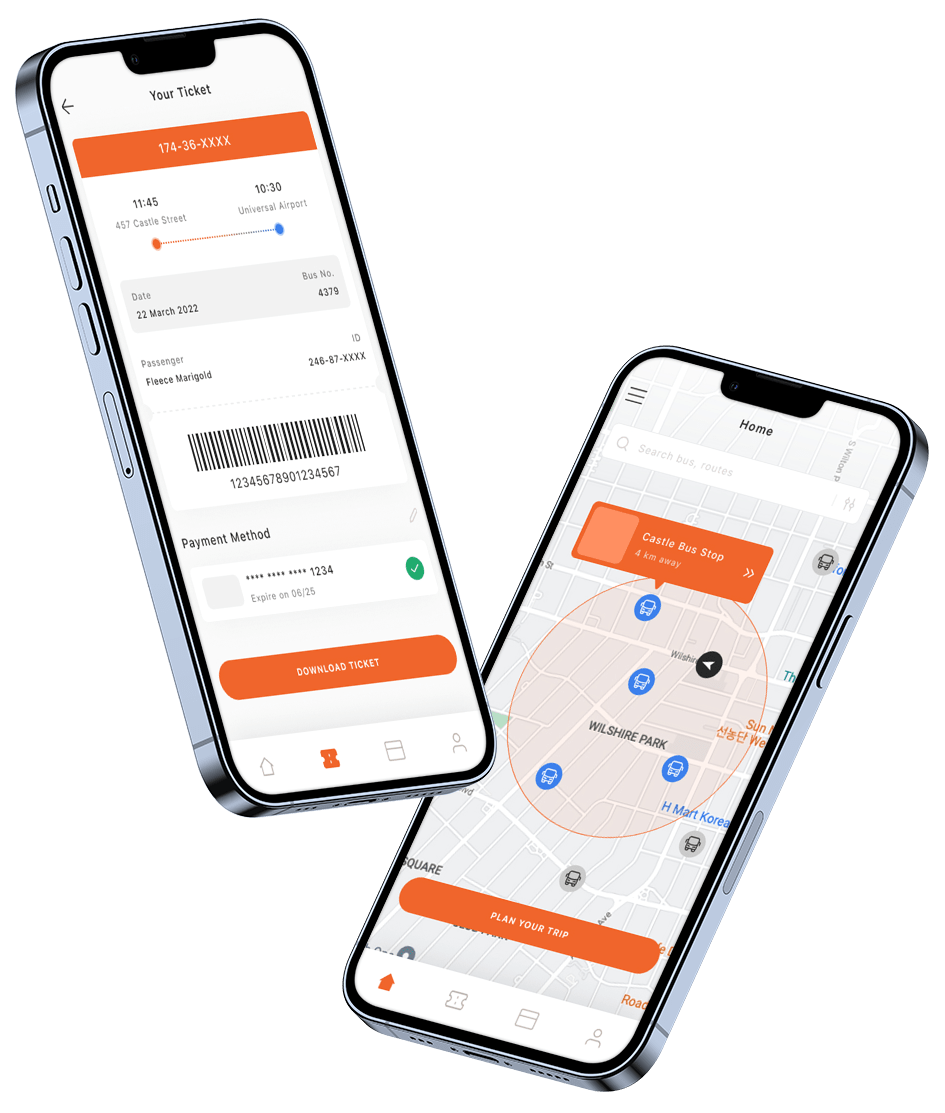

Download Our Application

Experience seamless wealth management at your fingertips! With our app, you can manage your investments, track your portfolio, and stay updated on market trends—all in one place.